We can all agree that the monthly energy bill is not exactly the most enjoyable letter to hold in your hand.

If you’re like most people, you’ll probably take a look at the sum owed, briefly wonder why it is so high, skim the partial charge breakdown with some frustration, pay, and forget all about it until the next billing cycle rolls around. But with the growing prices, have you started wondering whether there might be an option of paying less, perhaps by taking your business elsewhere?

The short answer is: yes, you can absolutely make smarter energy choices, and we’re here to show you how.

What is your bill trying to tell you?

The bottom line is this: the rates you pay depend on a myriad of factors, including the locally available energy mix, but also the global energy market, infrastructure and distribution costs, and various policies, programs, and taxes.

Put simply, power plants or generators use natural resources to churn out energy, which is then traded as a commodity on the wholesale market. Bought in bulk by retailers and intermediaries, it is next parcelled out to smaller retail markets, and eventually transmitted to you – the end user. The whole process relies on a network of delivery systems, companies and agencies, with some stages fully controlled by governments even in deregulated markets.

This complex web of variables means that the cost of electricity literally changes minute by minute, and the partial charges on the infamous bill in your hand are doing their best to reflect this ongoing process. The fact that there isn’t one accepted way of presenting pricing options and monthly statements by different energy providers doesn’t make things easier.

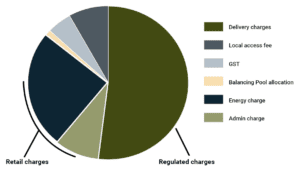

Here is what a breakdown can look like:

Source: Alberta Utilities Commission

With this in mind, we have prepared the following breakdown to help you understand, evaluate and compare fees:

Energy (electricity and natural gas) charges, or retailer charges refer to the price per unit (the kWh and GJ on your statement) for the electricity or gas used during the billing period. These might include the estimated and actual meter readings, when you pay a certain amount ahead of time and then adjustments or balancing credits are applied based on actual usage. Depending on your plan, some of your energy charges will be calculated at a fixed rate determined in your contract, and others at a variable rate, sometimes labeled as market price (for electricity) or index rate (for natural gas). You might also have an option of buying green energy credits to offset your electricity footprint with power generated from renewable sources, such as wind. The total energy charge is based on your consumption, but also on the competitive market, and you have options to make changes here – such as choosing a preferred retailer or a specific plan.

Transportation charges, sometimes called wire service provider charges and distributor delivery charges are usually non-negotiable, and likely make up the largest (sometimes even more than half) portion of your bill. They include:

-

- Transmission charges, which are regulated, mandatory, and meant to recover maintenance costs of the large power lines and pipes that run from remote production facilities to your territory. Whereas for residential clients these charges are based on energy use over the billing period and vary only slightly (depending on location), commercial customers pay them according to a tariff, based both on consumption and demand level or load. Further broken down into fixed and variable, they are topped up with transmission adjustment riders, charged or refunded to balance out the amounts paid in a previous period. There can only be one designated transmission company in a given territory.

-

- Distribution charges, also called utility or electricity / natural gas delivery charges, are regulated as well, but vary depending on location, age of the distribution system, and number of customers sharing the cost. Meant to cover the costs of installing and maintaining the smaller-scale distribution networks, including poles, wires, pipes, meters, etc., these charges are calculated by the distributor according to an approved tariff, and passed on to end users without markup from retailers. Their fixed component ensures that you stay plugged into the grid even if not currently consuming resources, while the variable part depends on usage. They can also include distribution riders. As in the case of transmission services, there can be only one designated distributor serving local retailers in a given area.

Administration charges cover your retailer’s billing, credit control and customer services, and are either based on the number of days in the billing period or fixed per month. Partial fees might be labeled as: billing fee, service charge, transaction fee, administration charge, retailer fee, etc. While they don’t usually make up a high percentage of your overall costs, they can vary significantly between retailers and are worth looking into.

Local access fees (for electricity) and municipal franchise fees (for natural gas), also called municipal assessment or municipal tax, are charged by local governments to distribution companies for the right to serve their residents and to have power lines and substations on municipal lands. These costs, usually minor, are passed on to the customers. Municipalities determine the level of these charges, so they are non-negotiable.

Rate riders are temporary, additional rates, separate from the monthly costs of usage. They can be listed as credits or charges, and your bill can include one or more. They are meant to flow through the yet unapproved costs incurred by, or refunded to, the retailer or the distribution utility. Usually they do not involve high amounts. Some examples of riders include unaccounted-for gas or electricity (UFG, UFE), line loss charge, special facilities charge, temporary / interim adjustment, system access service, load balancing, weather deferral account, energy market trading charges (EMTC), pool trading charges, and many more.

Taxes and credits are charges imposed by the governments both on federal and provincial / state level with the goal of encouraging transition to sustainable energy sources. These vary across territories and may include: carbon levy, cap and trade system, emission allowances service, federal carbon tax, and others.

We hope that this post helps you understand your energy charges and see the opportunity for change. If you’re curious about your options, contact us for a free assessment and expert assistance in finding an optimal plan for your enterprise.

Others articles you might like

Four ways your business can support the environment in 2023 and beyond

Fifty years ago, the first Earth Day was celebrated to raise awareness about such significant environmental challenges as water and air poll...

19 April 2022The top three things you need to make the best decisions for your energy spending

You already know this: the global energy landscape is changing. And you’re probably wondering how it will af...

16 March 2022Third quarter market forecast

In the third quarter, the Alberta power and natural gas market had remained quite volatile. We expect this ongoing volatility to continue to...

26 October 2021